6, Prem Kutir, Universtiy Road, Udaipur – 313001 Rajasthan, India

6, Prem Kutir, Universtiy Road, Udaipur – 313001 Rajasthan, India info@anilcomputersudaipur.com

info@anilcomputersudaipur.com 09414234600, 7737447183

09414234600, 7737447183

Hotel Accounting

Step 1

Create Company

GST- Yes

Step 2

Ledger Creation

1. Sales A/c

GST : Applicable

Types of supply-Service

2. CGST

UNDER: Duties & tax

Type of duty & tax-GST

Tax Type- Central Tax

3. SGST

UNDER: Duties & tax

Type of duty & tax-GST

Tax Type- State Tax

4. Laundry Services

Under: Indirect income

Include in assemble value calculations for- GST

Appropriate to - service

GST- No

5. Car Rental

Under: Indirect income

Include in assemble value calculations for- GST

Appropriate to - service

GST- No

6. Mr.SD A/c

Under: Sundry Debtors

Bill-By-Bill-Yes

Registration type: Unregirstrd/Consumer

Step 3

Create Stock Item

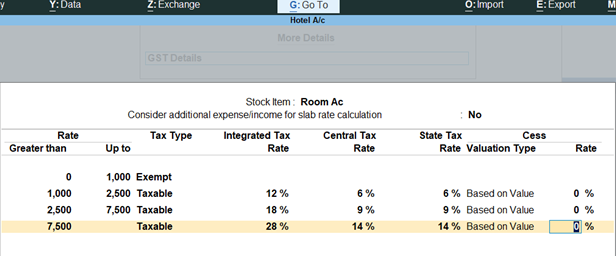

1. Room AC

Unit- Nos

GST: Applicable

GST Rate Details: Spacify Slab- based rates

स्लैब दर गणना के लिए अतिरिक्त व्यय आय पर विचार

Type Of supply: Service

F12- set options for stock item behaviour- Yes

Provide behaviour option- Yes

Treat all sales as new manufacture- Yes

2. Room - Non AC

जो प्रक्रिया आपने Room AC Stock item बनाने में कि वही प्रक्रिया Room- Non AC बनाने के लिए भी Same process follow करना है

3. Deluxe Room

GST: Applicable

Type Of supply: Service

Is Inclusive of Duties & Taxes : Yes

Rate of Duty: 18

Step 4

Voucher Entry

1. F8 (Sales)

Party A/c name: SD

Sales Ledger: Sales

Stock Item- Room AC

F12 Key Press- Provide additional descriptions for stock item- Yes

Stock Item में Description Add करना : Example : Room No. 203

Room number add करना

Quantity - 1

Amount - 5,000.00

CGST: 450.00

SGST: 450.00

2. Additional Service Provide करना Customers को

F8 (Sales)

Party A/c name: SD

Sales Ledger: Sales

Stock Item- Room- Non AC

Quantity - 1

Amount - 2,000.00

Laundry Services- 1000

Car Rental- 1000

CGST: 240.00

SGST: 240.00

Step 5

Display more reports > GST report > GSTR-1

# If Tax include in Our Price

Item Create >

1. Deluxe Room

GST: Applicable

Calculation Type- On Item Rate

Consider additional expenses income for slab rate calculation- No

स्लैब दर गणना के लिए अतिरिक्त व्यय आय पर विचार

Step 6

Voucher Entry (F8)

Rate (Inclusive of Tax)

Qunatity : 1

Rate : 7812.50

CGST : 1093.75

SGST : 1093.75

(Amount with Tax : 10,000)

^ A